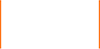

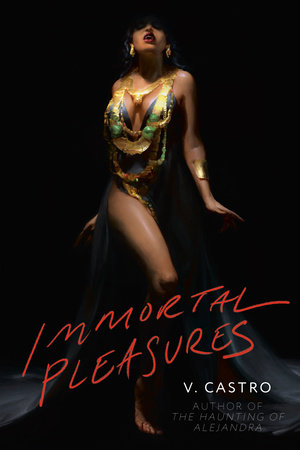

Indulge in a world of fantasy and romance with these books that offer the perfect combination of both.

Learn More

Indulge in a world of fantasy and romance with these books that offer the perfect combination of both.

Learn More

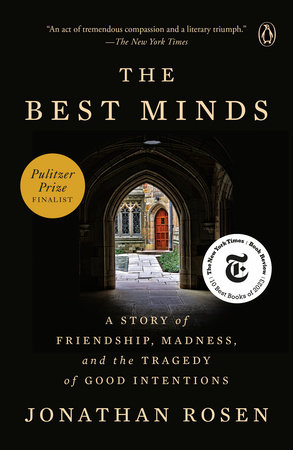

Recommended Right Now

Books To Read if You Love Challengers

If the film’s release has you looking for similar books, here are 10 novels that are sure to ace your expectations.

See the list

Books To Read if You Love Challengers

If the film’s release has you looking for similar books, here are 10 novels that are sure to ace your expectations.

See the list